The landscape of estate planning is undergoing a redefinition due to cross-border investments and the advent of digitalization. Expatriates face unique considerations in their estate planning, including inheritance tax and cross-border complexities. For expats residing in Dubai with assets in multiple countries, additional factors such as retirement plans, tax comparisons, beneficiary preferences, and socio-political and economic aspects must be taken into account. Distribution becomes more straightforward for portfolios consisting primarily of bank accounts and intangible assets, as opposed to those with real estate holdings.

Fortunately, the increasing global connectivity is simplifying estate planning efforts. High-net-worth individuals (HNWIs) and family offices in the GCC region are diversifying their portfolios across different financial markets and asset classes, maximizing returns and adapting to the evolving financial industry. These cross-border strategies not only facilitate tax-efficient and seamless wealth transfer but also support the goal of estate planning.

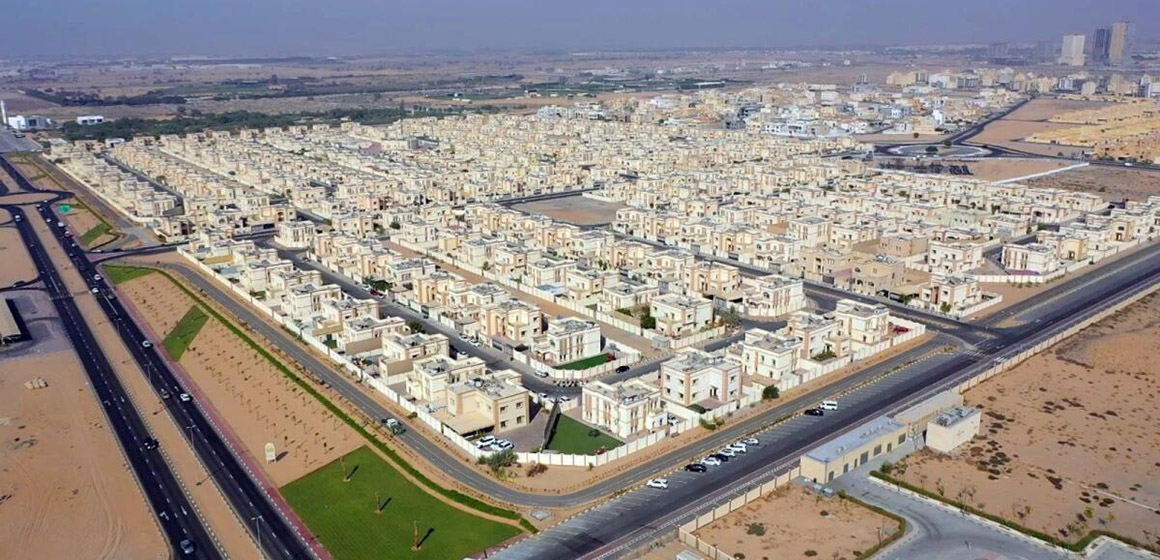

The rise of digitalization, alternative asset classes, and increased awareness of estate planning across income groups have prompted financial advisors to encourage early engagement in this conversation. It is believed that the best time to start estate planning is as early as possible, leveraging the advantages of a longer time horizon to optimize returns and mitigate risks. GCC economies offer favorable economic policies that incentivize long-term estate planning, including nominal personal income taxes, straightforward inheritance laws, and smooth processes for establishing, managing, and bequeathing trusts, especially in financial free zones. As a result, many HNWIs and family offices are choosing to invest in the region.

On the other hand, expatriates who plan to return to their home countries should prioritize estate planning in their respective jurisdictions, considering the tax implications of a cross-border portfolio. This may involve liquidating tangible assets while retaining intangible ones abroad and obtaining insurance coverage for potential future transfers. A long-term approach to estate planning allows expats to adjust their strategies as their residential circumstances change.

Trusts play a crucial role in estate planning, serving as a strategy to minimize inheritance tax. Financial advisors structure assets under trusts, with beneficiaries acting as trustees. Trusts provide protection against individual liability for inheritance tax, and specific assets, such as life insurance policies included in the trust, offer tax-free payouts to trustees. The benefits vary depending on the asset type. Expats, particularly HNWIs and family offices with global holdings and beneficiaries, can greatly benefit from trusts. Moreover, GCC nations are continuously enhancing their financial markets with expat- and investor-friendly reforms, embracing FinTech initiatives, and establishing dedicated centers for family businesses.

Digitalization has had a significant impact on expats’ estate planning, with promising prospects for the future. The widespread acceptance of digital documentation has streamlined and simplified processes, reducing paperwork and manual tasks. Initiatives like the Emirates Blockchain Strategy in the UAE have accelerated the shift toward paperless administrative procedures, enhancing immutability, transparency, and accessibility within the system. Digitalization has also opened up alternative avenues for long-term estate planning, such as investing in tokenized real estate or digital gold.

Blockchain technology holds the potential to revolutionize estate planning. Its immutable nature allows for the registration of smart and self-executing contracts, ensuring accurate and error-free documentation of identity, ownership, and transfers. Blockchain has the potential to replace traditional probate processes, significantly reducing legal complications. With GCC governments increasingly embracing blockchain technology, its institutionalization in the financial industry is foreseeable. Expats and those engaged in cross-border estate planning can benefit greatly from blockchain’s decentralized nature, transcending geographical and administrative boundaries

Overall, the combination of cross-border investments, digitalization, and evolving financial landscapes is reshaping estate planning for expatriates, offering new opportunities, efficiencies, and safeguards for wealth management and inheritance distribution.